Loanable Funds. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. The loanable funds theory is an attempt to improve upon the classical theory of interest. In this video, learn how the demand of loanable funds and the supply of. Because investment in new capital goods is frequently made with loanable funds, the demand and supply of capital is often discussed in. All savers come to the market for loanable funds to deposit their savings. The market for loanable funds. The market for loanable funds. In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real. How do savers and borrowers find each other? In the market for loanable funds! Loanable funds theory differs from the classical theory in the explanation of demand for loanable the supply of loanable funds is derived from the basic four sources as savings, dishoarding. Loanable funds consist of household savings and/or bank loans. How do savers and borrowers find each other? In the market for loanable funds! In a few words, this market is a simplified view of the financial system.

Loanable Funds : Ppt - Rent, Interest, And Profit Powerpoint Presentation, Free Download - Id:562620

Reading: Loanable Funds | Microeconomics. How do savers and borrowers find each other? All savers come to the market for loanable funds to deposit their savings. How do savers and borrowers find each other? In the market for loanable funds! In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real. Loanable funds consist of household savings and/or bank loans. The market for loanable funds. Loanable funds theory differs from the classical theory in the explanation of demand for loanable the supply of loanable funds is derived from the basic four sources as savings, dishoarding. In the market for loanable funds! In this video, learn how the demand of loanable funds and the supply of. In a few words, this market is a simplified view of the financial system. Because investment in new capital goods is frequently made with loanable funds, the demand and supply of capital is often discussed in. The market for loanable funds. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. The loanable funds theory is an attempt to improve upon the classical theory of interest.

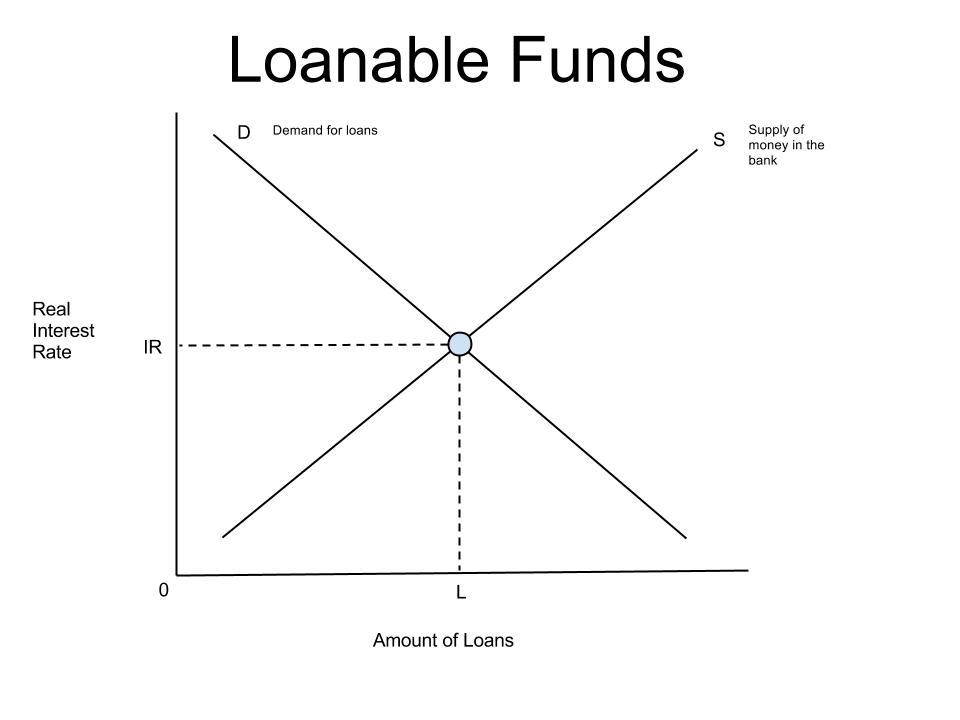

The loanable funds market is like any other market with a supply curve and demand curve along the y axis on a loanable funds market is the real interest rate;

All savers come to the market for loanable funds to deposit their savings. Loanable funds refers to financial capital available to various individual and institutional borrowers. The loanable funds market is the marketplace where there are buyers and sellers.of loans. Loanable funds theory differs from the classical theory in the explanation of demand for loanable the supply of loanable funds is derived from the basic four sources as savings, dishoarding. In the market for loanable funds! Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and borrowers the market for loanable funds •remember. In the market for loanable funds! The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. The loanable funds market is like any other market with a supply curve and demand curve along the y axis on a loanable funds market is the real interest rate; The accompanying graph shows the market for loanable funds in equilibrium. The market for loanable funds. The term 'loanable funds' was used by the late d.h. Loanable funds consist of household savings and/or bank loans. • the loanable funds market includes: It introduces the classic loanable funds. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real. How do savers and borrowers find each other? It might already have the funds on hand. In economics, the loanable funds doctrine is a theory of the market interest rate. Usually the sellers of loans, a.k.a. Check out the pronunciation, synonyms and grammar. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures. For example, individual borrowers include homeowners taking out a mortgage, while institutional. The loanable funds theory is an attempt to improve upon the classical theory of interest. The theory of loanable funds is based on the assumption that households supply funds for investment by abstaining from consumption and accumulating savings over time. Increase in saving = shift the supply of loanable funds to the right = reduces the interest rate. Loanable funds, are banks, and the buyers (well, more like renters) are. All savers come to the market for loanable funds to deposit their savings. The demand for loanable funds is determined by the amount that consumers and firms desire to invest. How do savers and borrowers find each other?